Real Estate Dcf Excel Template

• • • • • • • • • • • • • • Introduction Like many computer programmers, people who build financial models can get quite opinionated about the “right way” to do it. In fact, there is surprisingly little consistency across Wall Street around the structure of financial models. One reason is that models can vary widely in purpose. For example, if your task was to build a to be used in a as a valuation for one of 5 potential acquisition targets, it would likely be a waste of time to build a highly complex and feature-rich model. The time required to build a super complex DCF model isn’t justified given the model’s purpose. On the other hand, a leveraged finance model used to make thousands of loan approval decisions for a variety of loan types under a variety of scenarios necessitates a great deal of complexity.

Understanding the purpose of the model is key to determining its optimal structure. There are two primary determinants of a model’s ideal structure: granularity and flexibility. Let’s consider the following 5 common financial models: Model Purpose Granularity Flexibility One page DCF Used in a buy side pitch book to provide a valuation range for one of several potential acquisition targets. Matlab Mac Os X Download Crack on this page. Ball-park valuation range is sufficient) / Small.

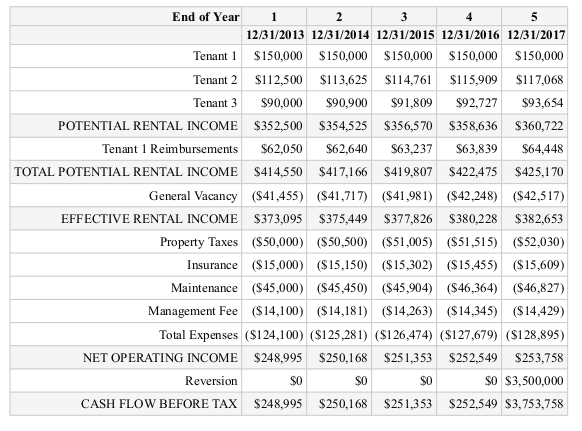

Nov 16, 2015. Commercial real estate (Income) property valuation by the discounted cash flow (DCF) method. Just like a company traded on the stock market, an income-producing real estate property can be valued based on the sum of the discounted values of its future expected cash flows. Jan 30, 2017. Real Estate Financial Model / Template for Multifamily Property. In this post you will find a template for the acquisition of a fictional 160 unit multifamily property. The template was developed in collaboration with a couple friends that are real estate professionals. Click here to download the Excel template.*.